In today’s competitive B2B landscape, timing is everything. The difference between closing a deal and losing to a competitor often comes down to reaching prospects at the exact moment they’re actively researching solutions. This is where intent data transforms your sales strategy from reactive to proactive. Learn more about what intent data is and why it’s revolutionizing B2B sales.

Intent data reveals which companies are actively researching topics related to your products or services, allowing your sales team to engage prospects when buying interest is highest. But collecting intent data is only half the battle—the real challenge lies in using it effectively. This comprehensive guide will show you how to implement B2B intent data strategies that drive measurable sales results.

What Makes Intent Data Powerful for B2B Sales

Intent data identifies behavioral signals that indicate a company is in-market for your solution. These signals include:

- Content consumption patterns (whitepapers, case studies, product comparisons)

- Search behavior around industry-specific keywords

- Technology research and evaluation activities

- Engagement with competitor content

- Questions asked on review sites and forums

When properly leveraged, intent data helps sales teams prioritize accounts with the highest propensity to buy, personalize outreach based on specific interests, and reduce time wasted on unqualified leads. See how intent data compares to traditional lead generation methods to understand why this approach delivers superior results.

Core B2B Intent Data Strategies

-

Layer Intent Data with Your Existing Sales Intelligence

Intent data shouldn’t exist in isolation. The most successful B2B sales teams integrate intent signals with their existing account data to create a complete picture of prospect readiness.

Implementation approach: Start by mapping intent topics to your product offerings and buyer personas. If you sell marketing automation software, intent signals around “lead scoring software,” “email marketing platforms,” or “marketing ROI tools” should trigger specific sales actions. Combine these intent signals with firmographic data (company size, industry, technology stack) and engagement history to create prioritized account lists. Discover how AI enhances intent data collection to make this integration even more powerful and accurate.

Best practice: Create an intent scoring model that weights different signals based on relevance. A company downloading multiple comparison guides scores higher than one reading a single blog post. Companies showing intent across multiple relevant topics deserve immediate attention.

-

Build Intent-Triggered Sales Plays

Generic outreach fails with today’s informed buyers. Intent data enables you to create targeted sales plays that address the specific challenges prospects are researching.

Implementation approach: Develop playbooks for each major intent topic. If a prospect is researching “data security compliance,” your sales play should include:

- Personalized email referencing their security research

- Relevant case study featuring similar companies in their industry

- Invitation to a compliance-focused webinar or demo

- Talking points about your security certifications and compliance features

Real-world example: A B2B SaaS company selling project management software noticed several enterprise accounts showing intent around “remote team collaboration tools.” They created a targeted play featuring their distributed team features, remote work case studies, and a custom ROI calculator. This intent-triggered approach increased their enterprise close rate by 34% compared to standard outreach.

-

Time Your Outreach Based on Intent Surge Patterns

Intent data isn’t static—it reveals momentum. Accounts showing sustained or increasing intent signals are significantly more likely to convert than those with declining interest.

Implementation approach: Monitor intent velocity, not just presence. Set up alerts for:

- Surge alerts: Companies showing 3x their normal intent activity

- New intent: Accounts entering your target market for the first time

- Sustained intent: Prospects researching consistently over 2-3 weeks

- Competitive intent: Companies researching your competitors

Tactical tip: The optimal outreach window is typically 7-14 days after initial intent signals appear. Too early, and prospects aren’t ready to engage with vendors. Too late, and competitors may have already established relationships.

-

Personalize Multi-Channel Campaigns with Intent Insights

Intent data reveals what prospects care about, enabling hyper-relevant messaging across every channel.

Implementation approach: Use intent topics to customize:

- Email subject lines: “Noticed you’re researching [intent topic]—here’s what companies like yours should know”

- LinkedIn outreach: Comment on their content consumption with valuable insights

- Display advertising: Retarget intent-showing accounts with ads addressing their specific research topics

- Sales call preparation: Reference their recent research to demonstrate relevance

Best practice: Focus on being helpful, not pushy. If a prospect is researching implementation challenges, share a detailed implementation guide or offer a consultation—don’t immediately pitch your product.

-

Align Sales and Marketing with Intent-Based Account Scoring

Intent data provides the common language sales and marketing teams need to agree on account prioritization.

Implementation approach: Create a unified account scoring model that includes:

- Fit score (firmographics, ICP alignment): 40%

- Intent score (research activity, topic relevance): 35%

- Engagement score (website visits, content downloads): 25%

Accounts scoring above 75 receive immediate sales attention. Accounts scoring 50-75 enter nurture campaigns. Below 50, they remain in marketing automation.

Real-world example: A B2B cybersecurity firm implemented intent-based scoring and reduced their sales cycle by 23%. Sales reps focused exclusively on high-intent accounts while marketing nurtured mid-tier prospects until they showed stronger buying signals. The result was higher conversion rates and better resource allocation.

Advanced Intent Data Tactics

Identify and Engage the Full Buying Committee

B2B purchases involve multiple stakeholders. Intent data can reveal who else at the target company is researching related topics.

Tactical approach: When you identify intent from one individual at a company, research other employees who might be involved in the decision. Look for job titles like:

- VPs and Directors in relevant departments

- IT and Security for technology decisions

- Finance leaders for high-value purchases

- End users who will implement the solution

Engage each stakeholder with role-specific messaging that addresses their unique concerns.

Use Negative Intent to Avoid Wasted Effort

Not all intent signals are positive. Prospects researching “alternatives to [your product]” or “how to cancel [your competitor]” provide valuable context.

Tactical approach: If existing customers show intent around competitor research or product alternatives, trigger customer success interventions before they churn. If prospects research your product then stop, follow up with targeted re-engagement content addressing common objections.

Monitor Competitive Intent for Strategic Opportunities

When prospects research your competitors, you have an opportunity to differentiate.

Tactical approach: Create battle cards for each major competitor. When intent data shows a prospect researching a competitor, equip your sales team with:

- Competitive differentiation messaging

- Comparison content highlighting your advantages

- Customer stories of companies that switched from that competitor

- Proactive objection handling for that competitor’s strengths

Measuring Intent Data Impact on Sales Performance

To validate your B2B intent data strategies, track these key metrics:

Leading indicators:

- Percentage of opportunities sourced from intent signals

- Time from intent signal to first engagement

- Response rates on intent-triggered outreach vs. cold outreach

Conversion metrics:

- Lead-to-opportunity conversion rate for intent-qualified accounts

- Win rate for deals influenced by intent data

- Sales cycle length for intent-sourced vs. traditionally sourced deals

Business impact:

- Revenue influenced by intent data

- CAC (Customer Acquisition Cost) for intent-qualified customers

- Pipeline coverage from intent-identified accounts

Common Intent Data Mistakes to Avoid

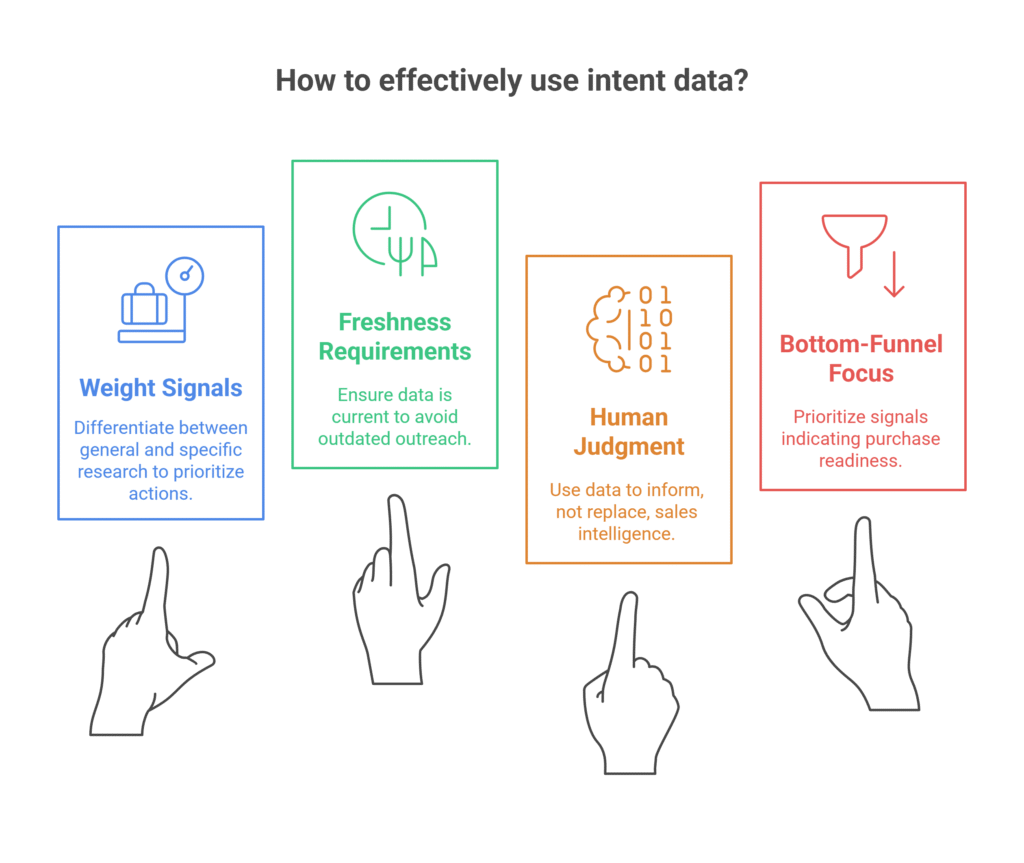

Mistake 1: Treating all intent signals equally. Research on general industry trends differs vastly from research on specific product features or pricing. Weight your signals appropriately.

Mistake 2: Ignoring intent decay. Intent signals grow stale. A company researching your category three months ago may have already purchased. Establish freshness requirements for your intent data.

Mistake 3: Over-automating without human judgment. Intent data should inform, not replace, sales intelligence. Not every intent signal warrants immediate outreach—context matters.

Mistake 4: Focusing only on top-of-funnel intent. Bottom-funnel intent signals (pricing research, demo requests, comparison shopping) deserve different treatment than educational content consumption.

Getting Started: Your 30-Day Intent Data Implementation Plan

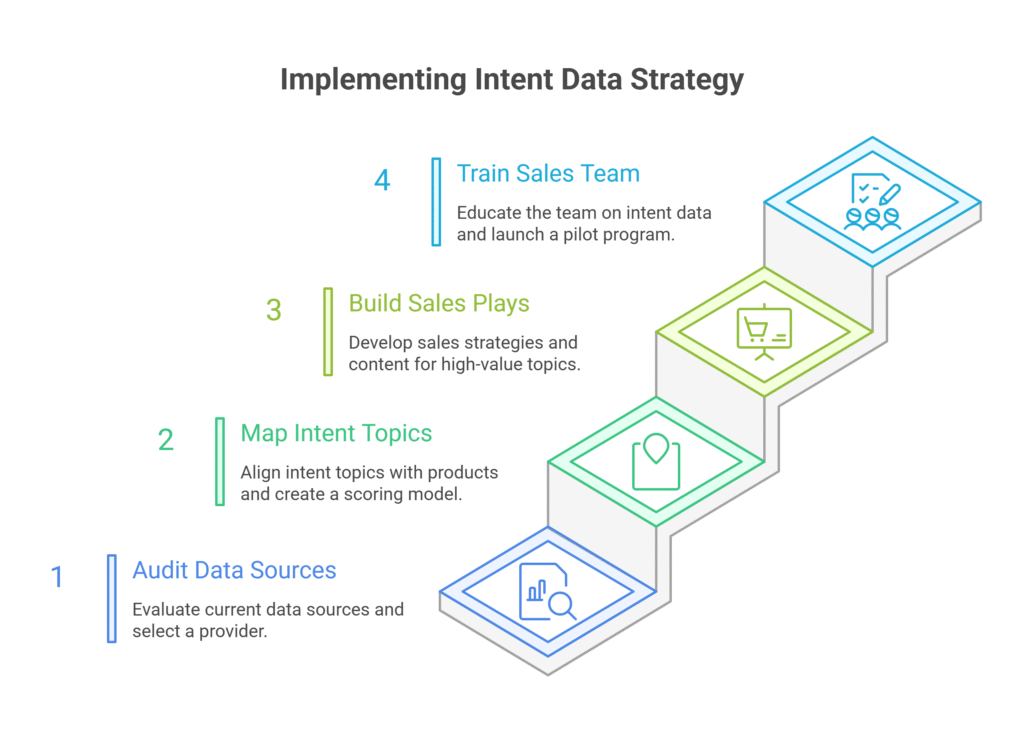

Week 1: Audit your current data sources and select an intent data provider that aligns with your ICP and budget. Popular options include Bombora, 6sense, and ZoomInfo Intent.

Week 2: Map intent topics to your products and create your intent scoring model. Start simple with 10-15 high-priority intent topics.

Week 3: Build your first two sales plays for your highest-value intent topics. Create email templates, talking points, and relevant content assets.

Week 4: Train your sales team on intent data concepts and launch a pilot program with your top performers. Measure results and iterate.

The Future of Intent-Driven B2B Sales

As buyers conduct more research digitally and engage with vendors later in their journey, intent data becomes increasingly essential. The companies that master using intent data won’t just improve their sales efficiency—they’ll fundamentally transform how they go to market.

Start by implementing one or two of these strategies, measure results, and expand your intent data program over time. The competitive advantage goes to sales teams that can identify buying signals before competitors and engage with relevance that cuts through the noise.

Your prospects are researching solutions right now. The question is: will you reach them first?

Frequently Asked Questions (FAQs)

1. What is B2B intent data and how does it work?

B2B intent data tracks behavioral signals across the web to identify companies actively researching products or services like yours. These signals include content downloads, search patterns, and topic engagement, helping sales teams prioritize outreach to prospects with the highest buying interest.

2. How much does intent data cost for B2B sales teams?

Intent data costs vary by provider and features. Entry-level plans start at $1,000-$3,000 monthly for small teams, while enterprise solutions range from $10,000-$50,000+ annually. Pricing typically depends on accounts monitored, topics tracked, and integration capabilities.

3. What’s the difference between first-party and third-party intent data?

First-party intent data comes from your own digital properties (website visits, downloads, email engagement). Third-party intent data tracks research behavior across external sites and publications. The most effective strategies combine both to capture the full buyer journey.

4. How quickly can we see results from implementing intent data?

Most teams see initial results within 30-60 days, including 2-3x higher email response rates. Meaningful pipeline impact appears within 90 days, while full ROI validation typically takes 4-6 months due to B2B sales cycles.

5. How do you prevent intent data from overwhelming your sales team?

Start by tracking 10-15 high-value intent topics and focus on accounts matching your ICP. Set up automated alerts only for strong buying signals like surge activity or competitive research. Create clear prioritization rules and response time SLAs for different intent score tiers.

6. Can intent data help with account-based marketing (ABM)?

Yes, intent data is highly valuable for ABM. It identifies which target accounts are actively in-market, reveals relevant messaging for personalization, and helps discover new target accounts showing similar research patterns to your best customers.

7. How accurate is B2B intent data?

Accuracy varies by provider, but intent data reliably identifies research behavior. Context matters—companies may be months from purchase or researching for other reasons. Combining multiple signals over time with firmographic data yields 20-40% conversion to qualified opportunities.

8. What metrics should we track to measure intent data ROI?

Track response rates on intent-triggered outreach, lead-to-opportunity conversion rates, win rates for intent-influenced deals, and sales cycle length. Also measure revenue influenced by intent data and customer acquisition costs compared to traditional methods.

9. How often should intent data be updated or refreshed?

Intent data should update in real-time or within 24-48 hours, as buying intent shifts rapidly. Prioritize signals from the past 7-14 days for action—signals older than 30 days often indicate the opportunity has passed.

10. Can small B2B companies benefit from intent data or is it only for enterprises?

Small and mid-sized companies often see faster ROI from intent data due to focused target markets and agile execution. Start with 5-10 relevant intent topics, prioritize ICP-fit accounts, and create 2-3 targeted sales plays. Many providers offer scaled pricing for smaller teams.